Our technology helps Quid achieve its number one objective to build and fully integrate all products on the ecosystem so business owners can connect everything on one simple platform.

The founders at Quid had a brilliant idea, the compliance, and business structure.

They lacked an exceptional IT partner that could help them go from zero to hero and achieve their goal of becoming a one-stop business and banking ecosystem for entrepreneurs around the world.

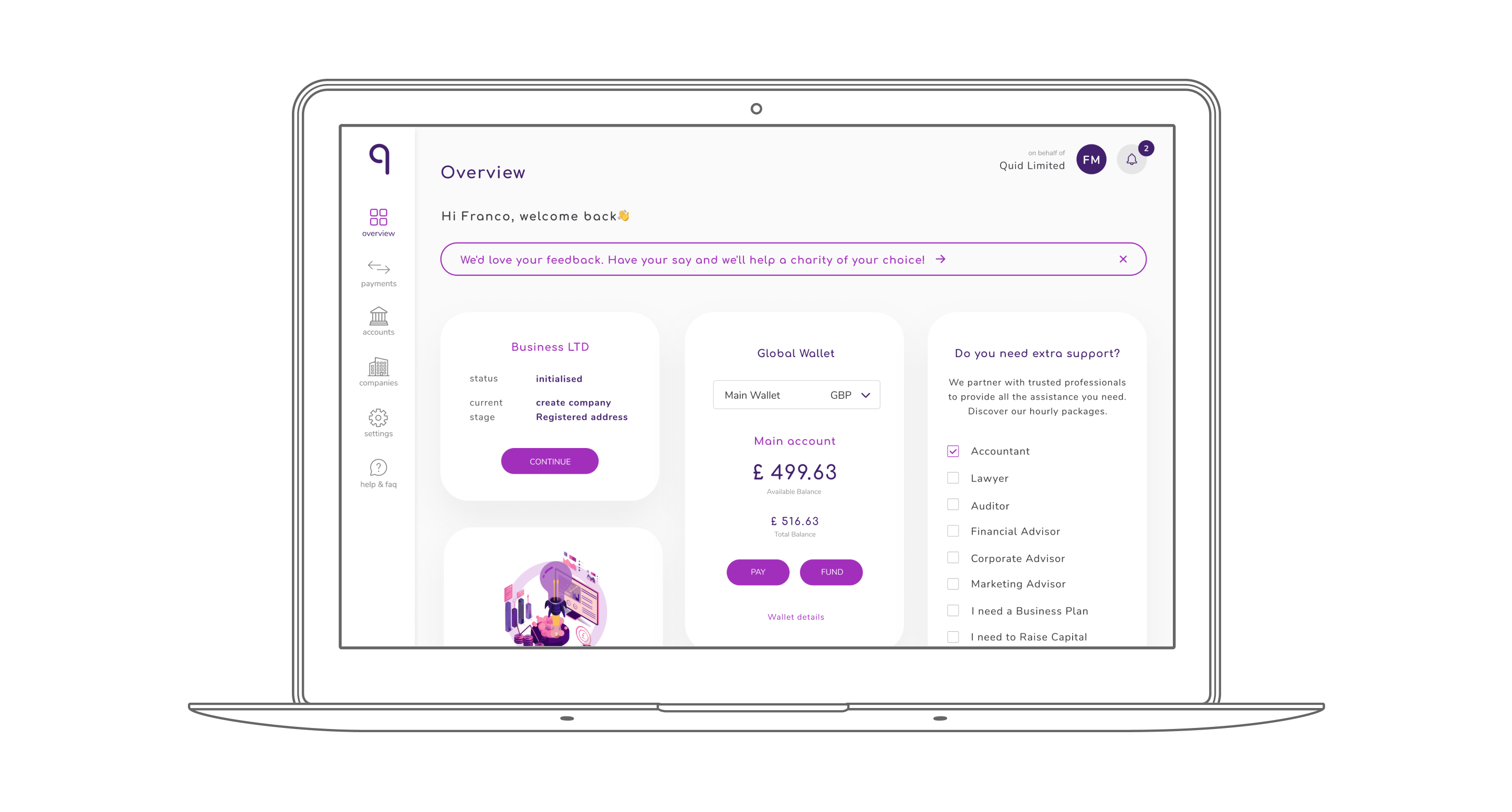

Scoped requirements, built a prototype and delivered a multi-application MVP financial ecosystem with a simple interface

Support the team with best-practice technology ensuring they are fully compliant with the latest data security and regulatory requirements in several jurisdictions

Provide end-to-end software development lifecycle including feature inception, research, third-party provider selection, and future iterations

Our modular technology offering helps Quid give its customers a growing, innovative financial ecosystem that is fully integrated and easy to manage with a single sign-on.

One of Quid’s main requirements was to ensure that onboarding was quick, intuitive, and interactive to increase user registrations. PortIT helps Quid build customer profiles which collect data and documents each time a customer applies for products in the ecosystem, reducing normal signup and onboarding times by over 60%.

As Quid offers a range of payment and banking tools, they need to undertake thorough customer due diligence. Our automated tool extracts and compares official company documents from several trusted global sources. So, Quid can verify individuals and entities in real-time, completing KYC and KYB in a matter of seconds.

We built a next-generation back office to automate customer requests, ticket escalations and internal processes. We applied the “four-eyes” principle to enable fast decision making while ensuring effective controls and approvals. These time-saving measures, including built-in workflows, filters, permission levels, audit trails and reporting, save the Quid team hours every week. All backed up with industry-grade security.

We’re helping Quid deliver their one-stop ecosystem where entrepreneurs can launch, manage, and grow their business with a fully integrated set of core tools. We have built and continue to update robust solutions for company formation and company maintenance, Xero and QuickBooks accounting, automated KYC and more in New Zealand, the US, UK and Europe. Quid saves thousands of pounds in development costs in the process.

Quid offers business owners a range of payment solutions. From Multi-currency wallets, to local and international payments, to FX, we have developed a customer friendly front-end solution that supports settlement, billing, one-off payments, subscriptions, promo codes and more.

We allow customers to have different fee schemas and fee setups for their end customers. We worked with Quid to set up fee structures and rules with built-in logic, and flexible workflows for each of the types of fees. We created a customised solution to automatically collect payments, synch collections with internal financial systems and back offices, and grow revenue.

Our acquiring module helps Quid collect card payments from its customers in multiple-currencies, supports cross-currency settlement and provides a tailored, self-service back-office. Complete with management information, transaction reporting, analytics and an entire audit trail.

PortIT Limited

20 Fitzroy Square, London, United Kingdom, W1T 6EJ

Registration Number: 12213604